ESG - Environment, Social, and Governance

ESG Risk Management Module (Own and Third-Party Risks)

ContactWhat is ESG?

Environment, Social, and Governance (ESG): refers to the environmental, social, and governance sustainability issues of public and private organizations.

Environmental: refers to the company or entity’s practices oriented towards the environment. This includes issues such as global warming; emission of pollutants like carbon and methane; air and water pollution; deforestation; waste management; energy efficiency; biodiversity; among others.

Social: relates to social responsibility and the impact of companies and entities on the community and society. It primarily refers to issues such as respect for human rights and labor laws; workplace safety; fair wages; gender, race, ethnicity, creed diversity, etc.; data protection and privacy; customer satisfaction; social investment; and relationship with the local community.

Governance: is linked to the policies, processes, strategies, and management directions of companies and entities. It includes issues such as corporate conduct; board composition and independence; anti-corruption practices; existence of whistleblowing channels for discrimination, harassment, and corruption cases; internal and external audits; respect for consumer, supplier, and investor rights; data transparency; executive compensation; among others. It is closely related to the other two terms (Social and Environmental), as it dictates, guides, oversees, and reports on sustainable (or not) practices.

In summary, the term ESG has become a way to refer to what companies and entities are doing to be socially responsible, environmentally sustainable, and well-managed. Increasingly, social and environmental performance will need to be incorporated into companies' financial performance reports: People, Planet, Profit are known as the “3Ps of Sustainability.”

Why Manage ESG Risks?

Best ESG practices are associated with solid businesses, lower capital costs, better resilience against climate and sustainability-related risks.

Currently, sustainable practices are a business differentiator, but they will become a standard in the short to medium term.

Adopting an ESG model means a commitment to sustainability, combining financial results with creating a positive impact on society.

ESG Risk Management

“Improve your ESG risk management process!”

Currently, the volume of information, the difficulty of identifying it, and the complexity of the risks involved in the ESG agenda exceed the capacity for manual risk management. Data identification and analysis through Big Data, along with Artificial Intelligence technologies, provide significant benefits to ESG and business risk management processes. Take your company’s ESG risk management to the next level!

The t-Risk ESG provides the organizational transparency and visibility necessary to gain intelligence in ESG risk management, enabling timely communications between stakeholders and accurate reporting so the organization can focus on improving performance and sustainability within the ESG agenda.

Contact

Continuous Monitoring for Immediate Decision-Making

Artificial intelligence, business intelligence, experience, and methodology combined to offer more than just data collection:

Over 100 Databases

Ibama, infringement records, potentially contaminating activities reports, Environmental Secretariat, Courts, TCU, Federal Revenue, slave labor, Ministry of Labor, protests, legal proceedings, among others.

Immediate Decision-Making

Queries completed in seconds with risk confirmation based on artificial intelligence, through risk source context analysis.

Continuous Monitoring

Ongoing monitoring of risks through automated routines, allowing immediate tracking of risk exposure and timely prevention measures.

Using the t-Risk Platform to Manage Risks

The t-Risk Platform (SaaS) has been available since 2015 to support organizations in managing their risks. An analytical tool that helps in identification, analysis, and risk evaluation, as well as supporting prioritization and risk treatment processes. It conforms to the risk management process defined in ISO 31.000. Available in Portuguese, English, and Spanish, it increases productivity by up to 80%.

After defining the controls to be implemented, improved, or maintained, to keep risks within the organization’s risk appetite, it will still be possible to monitor all projects, tasks, and controls through the 5W2H project management module.

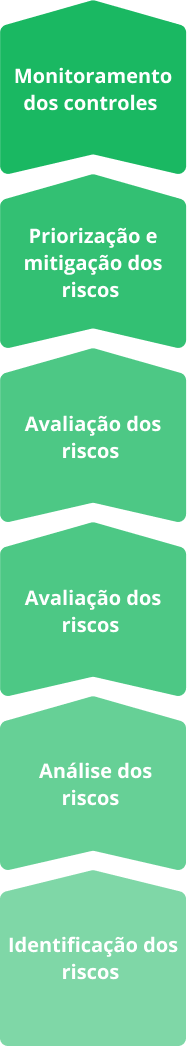

CONTACTESG Risk Management Process

A large part of this process can be automated, saving time and organizational resources, and reducing the risk of human errors. No matter where your organization is on this path, using software to manage ESG risks will help achieve desired goals, reduce uncertainties and losses, and increase resilience.

t-Risk ESG Module

The ESG Risk Management Module of the t-Risk Platform collaborates with the digital transformation of organizations, revolutionizing the ESG risk management process, providing agile, effective decision-making, reducing costs in numerous activities, such as:

- Evaluation of third-party ESG risks (suppliers and partners);

- Ongoing monitoring of ESG risks (own and third-party);

- Support in merger and acquisition processes;

- Remote audits, Due Diligence and support in investigations;

- Action plan (5W2H) for mitigating risks, tracking pending tasks and deadlines with automatic email sending;

- Charts and dashboards for real-time tracking;

- Fast and flexible creation of reports for board meetings;

- Simplicity in data collection, calculation, and report generation.

More Control and Anticipation

Efficient ESG data compilation for disclosure reports, ESG performance benchmarking, process optimization, and action plans that directly contribute to positive results in the ESG agenda. The t-Risk Platform can help your organization.

Protecting Regulatory Compliance

Resolve issues before they become violations or fines, helping your organization stay ahead of inspections and audits. Calculate the ROI of sustainability projects.

Driving Holistic Sustainability Programs

Create action plans and sustainability initiatives with task allocation resources at various levels to address gaps and easily monitor timelines.

Transform ESG Risk Management into a Strategic Process

Transform ESG data into an Integrated Risk Assessment, visualizing developments in long-term strategy and impacts on critical success factors.